Woolworths Limited (Woolworths) made their ‘final profit and dividend announcement for the 52 weeks ended 28 June 2015’ on 28 August 2015.

Sales were $60.7 billion for the 2015 financial year, a decrease of 0.2%. This is the result of changes to the agreement between Woolworths and Caltex, declining average fuel sale price, as well as a disappointing trading result in Australian Food and Liquor and General Merchandise.

Total petrol sales for the year were $5.6 billion, which represents a decrease of 20.3% in value on the previous year, while volume sales decreased by 13.1%. The figures were impacted by the changes to the Woolworths—Caltex alliance, which saw the exit of 131 Caltex operated sites from the joint venture.

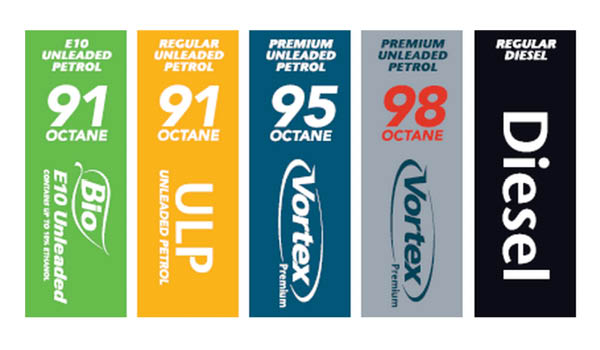

Woolworths no longer records the sales from these sites. Of these sites, 92 were re-branded as ‘Star Mart’ or ‘Star Shop’ and these sites still offer the Woolworths fuel discount redemption. The other 39 sites, which were situated close to Woolworths Petrol sites, have completely exited the alliance and thus no longer offer the fuel discount. The remaining 502 sites that comprise the Caltex fuel network continue to be operated by Woolworths.

Declining global oil prices negatively impacted comparable petrol sales (dollars), which decreased 10.7%. Comparable volumes also declined by 2.3% as a result of reduced fuel discount activity following the implementation of limited fuel discount availability in line with the AAAC ruling.

The cost of doing business as a percentage of sales increased 0.42% on the 2014 financial year to equal 21.3%. This was caused by subdued sales growth thanks again to the altered Woolworths—Caltex alliance, which limited the ability to fractionalise costs.

The situation is not all dire for the group as a whole though – Woolworths Chief Executive Officer, Grant O’Brien said: “Woolworths today reported net profit after tax of $2.45 billion before significant items for FY15. In a year of clear challenges and structural change, we have delivered sales and profit in line with the prior year, albeit below our expectations.”